Obtaining reliable and complete ESG data can be particularly challenging when dealing with privately-held firms or those operating in regions with weaker disclosure standards.

The absence of standardised ESG metrics makes it difficult for private equity firms to benchmark ESG performance across industries, geographies, and company sizes.

Integrating ESG factors into traditional financial models is no simple task, especially when considering early-stage companies that may not have well-established ESG practices.

Gaining transparency into the ESG risks embedded within a target company’s operations, supply chain, and governance structures can be time consuming.

Private Equity firms need to comply with various stakeholder reporting, and this often needs dedicated teams or resources to focus on non-core reporting activities.

Identifying and mitigating long-term ESG risks, including reputational and regulatory concerns, requires predictive insights that can evolve with market dynamics.

Streamline ESG integration in private equity by providing AI-powered, tailored ESG data and insights, to efficiently assess and compare potential investments and ensure compliance. Complete your due diligence within a day not months.

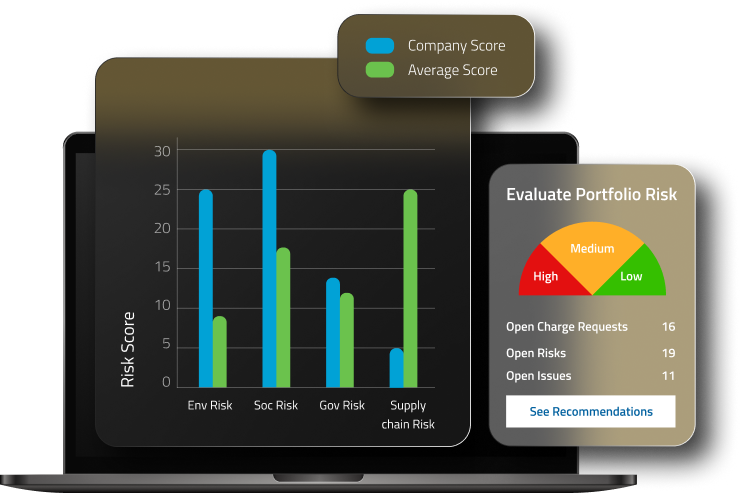

Assess ESG performance, identify risks, and forecast the financial impact of ESG factors, ensure alignment with sustainability goals and generate reports for your internal & external stakeholders. We support Private equity with their SFDR reporting, Portfolio emissions, Financed emissions estimation and Net Zero alignment requirements.

With ESGSure our AI platform, gain insights on your portfolio companies in seconds, and perform detailed research including controversy tracking.

With fully customisable platform datasets help Private equity benchmark their portfolio identify gaps and generate portfolio-level ESG reports.

Proactively manages ESG risks over the lifecycle of investments, addressing both current and future concerns with predictive analytics.