Sourcing and aggregating reliable ESG data from multiple sources while ensuring accuracy and completeness can be complex and expensive.

Verifying the authenticity of ESG claims requires advanced tools to detect discrepancies and ensure transparency.

Surge in demand for ESG investments and screening has resulted in unprecedented levels of regulatory pressure. Asset managers need to adequately prepare and implement systems in place to adapt to regulatory and compliance risks.

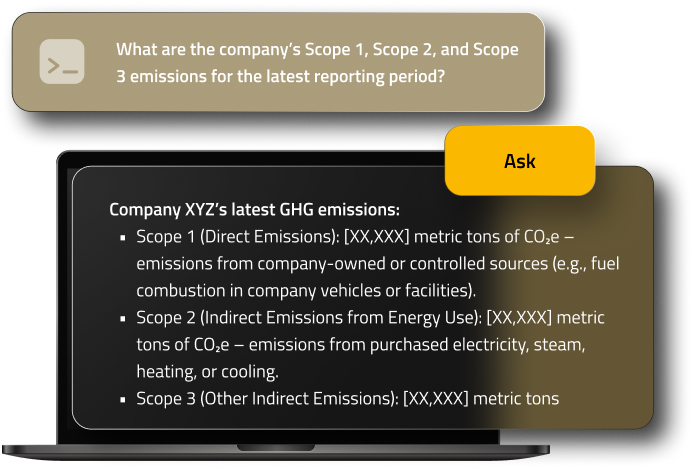

Embedding ESG insights into financial models and strategies demands actionable, data-driven intelligence.

Ensuring portfolios are aligned with net-zero goals requires robust tools to measure financed emissions and track progress against decarbonization objectives.

The sheer volume of ESG data creates complexity, especially when real-time monitoring and insights are needed.

Unlock real-time, AI-powered insights with ESGSure. Our platform delivers the latest ESG data, news, and analysis for over 15,000 companies, enabling you to stay ahead of market trends and risks.

Find the tools you need to conduct thorough ESG and Climate risk assessments with ease. Automate your regulatory reporting and stakeholder compliance requirements like SFDR reporting, Net Zero alignment of Portfolio companies.

Access comprehensive Public and Private market ESG datasets and real-time company news, AI-powered align with financial & sustainability goals.

Measure ESG and climate risk across your portfolio with analytics, customization, and issuer engagement tools for proactive management.

Use our customisable platforms to align your assessments with global frameworks, regulations and client specific methodology.