Banks face pressure to accurately assess and mitigate climate-related risks, including transition and physical risks affecting assets and portfolios.

Banks and other Financial institutions face challenges managing large volumes of ESG data, often dealing with fragmented data sources and reporting standards.

Lack of readily available private market data and manually intensive 3rd party platforms for data capture slows down the process.

As regulatory frameworks evolve rapidly, banks require reliable tools for managing Financial and Non-financial data for their risk assessments, with ability to integrate 3rd party data for comprehensive analysis.

Identifying and prioritising sustainable investment opportunities remains a challenge, requiring robust data integration and tools to align portfolios with ESG goals.

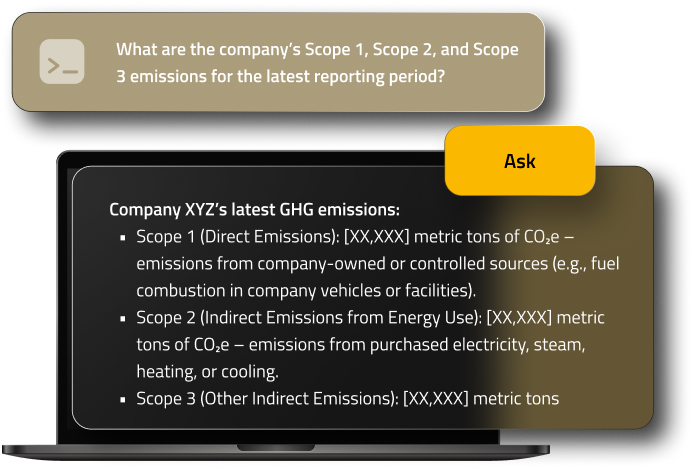

AI-powered platform providing the latest ESG data, insights, and news for over 15,000 global companies and private company research.

A glass-box platform designed to capture and manage critical financial and non-financial data at scale. Stay ahead of evolving regulations and manage all portfolio data capture and analysis in a single platform.

Tools for conducting portfolio assessments, automate financed emissions reporting, and integrating climate risk into Probability of Default (PD) and Loss Given Default (LGD) models.

Track and mitigate both transition and physical climate risks to ensure the long-term resilience of your portfolios.

Get reliable ESG data & insights for 15,000+ companies, informing better decisions, risk management & compliance.

Unlock efficient ESG data management with ESGSure's AI platform, reducing complexity, cost, and enhancing data accuracy.

Simplify ESG assessments or accuracy of financed emissions estimates, ensuring alignment requirements and global sustainability goals.

Leverage advanced analytics to integrate ESG risks financial models, boosting strategic planning, investment and overall sustainability practices.