Detects and addresses ESG risks across investment portfolios, corporate operations, and value chains with foresight and precision.

Custom made for wide industry use cases and not a one-size-fits-all approach.

Financed emissions reporting and transition and physical risk dashboards for banks and financial industry.

Align your ESG strategy with long-term business goals and automate corporate and supply chain assessments.

Our domain experts help you stay on top of the evolving regulations and investment requirements. Our plug and play platforms with customisation features allow you to meet your sustainability objectives.

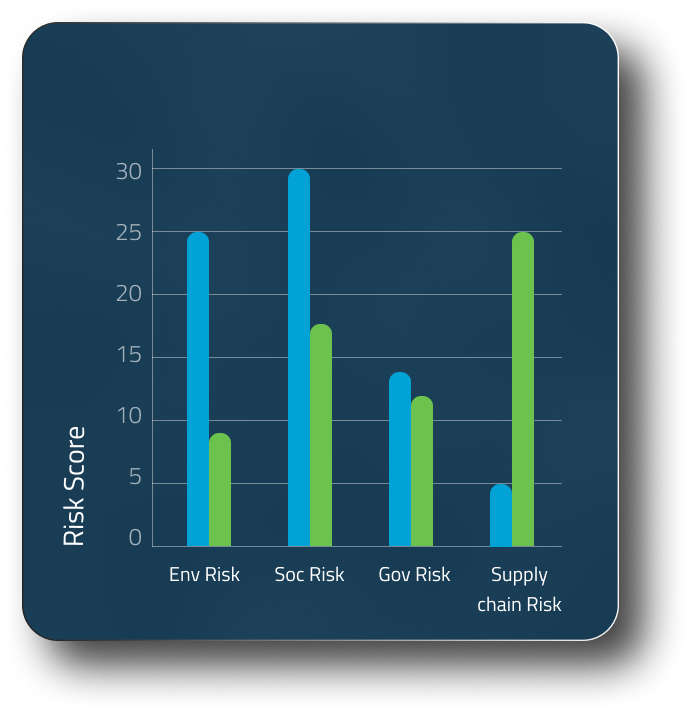

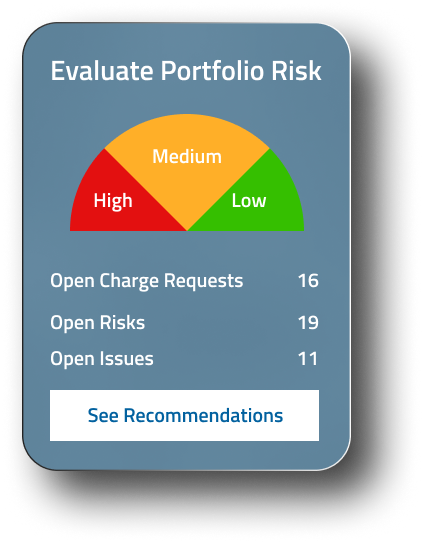

Utilize intuitive dashboards for portfolio assessments, SFDR compliance tracking, Net Zero progress monitoring, and supply chain risk evaluation.

Identify gaps in your ESG strategy, compliance, and implementation to ensure alignment with sustainability goals.

Evaluate risks across environmental, social, and governance factors to assess their potential impact on operations and performance.

Forecast the long-term financial impacts of climate risk.

Helping investors and businesses adopt a preemptive approach to managing their ESG challenges.

Minimizing uncertainty regarding ESG risks and their potential financial impacts.

Advanced technology platforms help our clients gain efficiency and improve quality.